The European Union’s (EU) ambitious Beating Cancer Plan sets as a goal creating a Tobacco-Free Generation by the year 2040, with an intermediate target of reducing tobacco use to 20% by 2025.

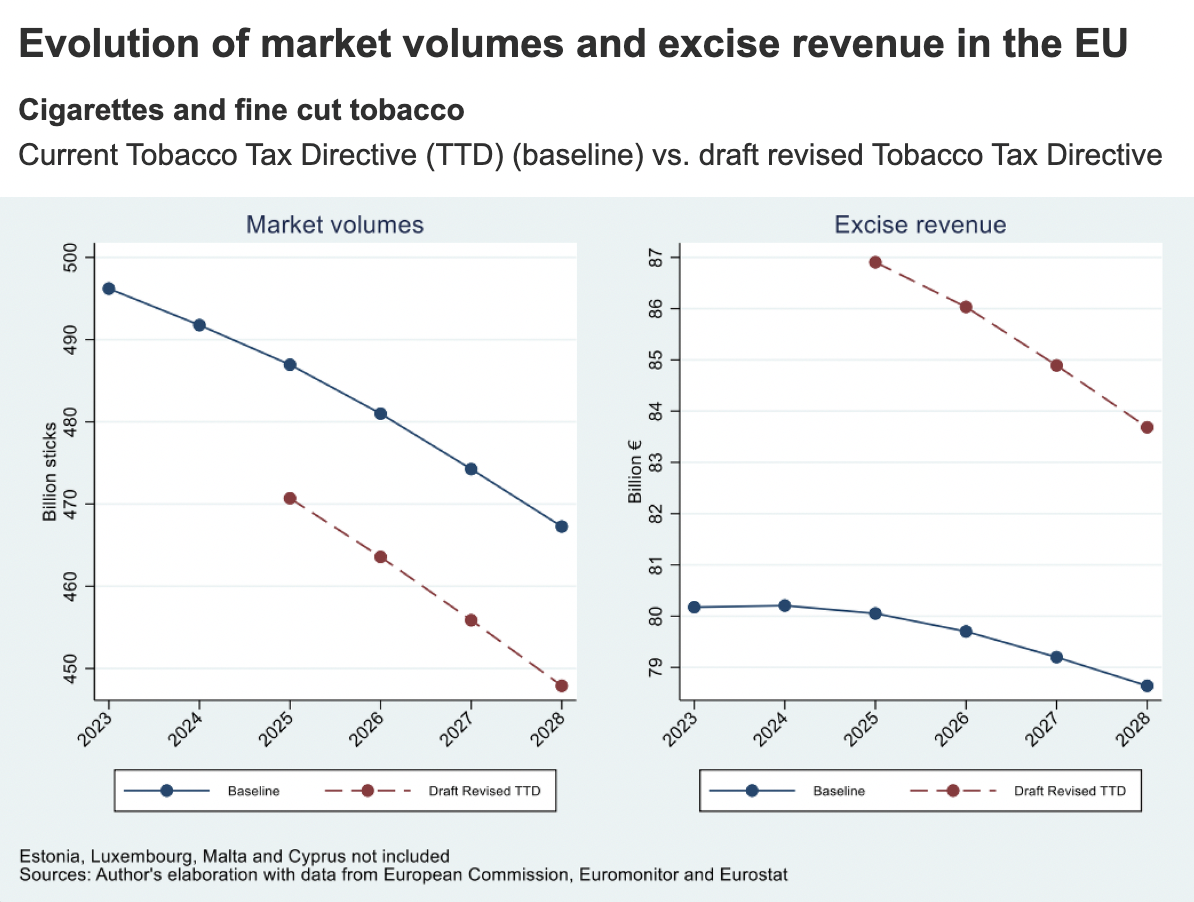

A key element of the Plan involves revising the Tobacco Tax Directive (TTD) to decrease demand for tobacco. Although there are no official indications on the contents of the revisions and their date of implementation, the European Commission’s proposals have circulated unofficially, and their impact on product prices, market demand, and excise revenue have been analyzed here. The findings indicate that the Commission’s proposals would lead to retail price increases in all EU member states except for those with the highest current tax rates. The impact on market demand for these products is estimated to be modest, with yearly reductions in demand of about 3.5% and yearly excise revenue increases of about 7%.