References

Consumption (map and regional figure):

Euromonitor. Passport database (accessed in April 2022).

GlobalData. 2021 database. www.globaldata.com.

Menthol:

Przewoźniak K, Kyriakos CN, Hiscock R, Radu-Loghin C, Fong GT. Effects of and challenges to bans on menthol and other flavors in tobacco products. Tob Prev Cessat. 2021 Nov 15;7:68. doi: 10.18332/tpc/143072.

Villanti AC, Collins LK, Niaura RS, Gagosian SY, Abrams DB. Menthol cigarettes and the public health standard: a systematic review. BMC Public Health. 2017 Dec;17(1):1-3.

Villanti AC, Mowery PD, Delnevo CD, Niaura RS, Abrams DB, Giovino GA. Changes in the prevalence and correlates of menthol cigarette use in the USA, 2004–2014. Tobacco control. 2016 Nov 1;25(Suppl 2):ii14-20.

Reduced nicotine cigarettes:

Donny EC, White CM. A review of the evidence on cigarettes with reduced addictiveness potential. International Journal of Drug Policy. 2021 Sep 15:103436.

Smoking prevalence projections:

WHO global report on trends in prevalence of tobacco use 2000-2025, fourth edition. Geneva: World Health Organization; 2021.

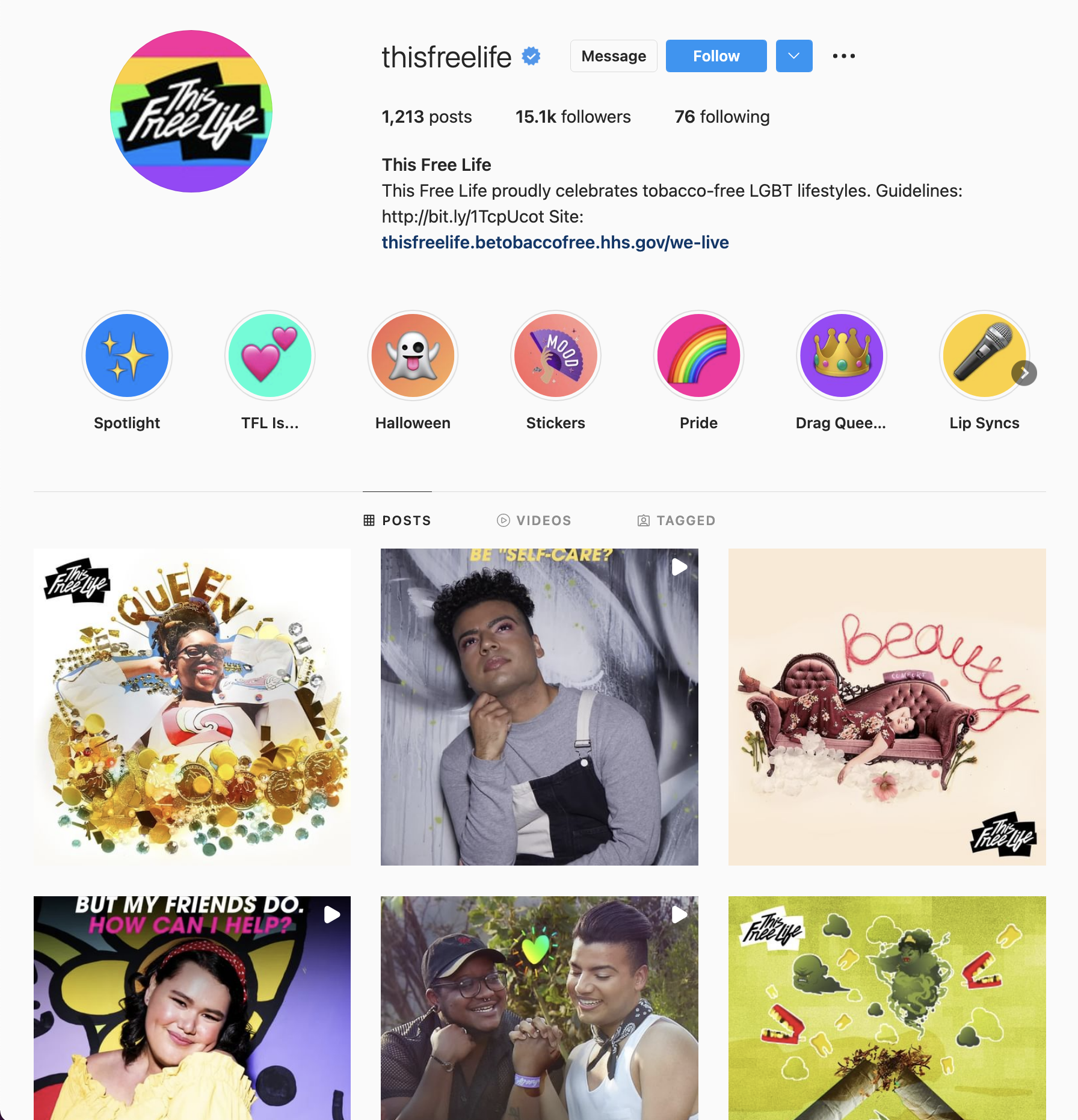

This Free Life campaign:

US Food and Drug Administration. 2022. This Free Life Campaign. https://www.fda.gov/tobacco-products/public-health-education-campaigns/free-life-campaign. Last accessed 5/3/2022.

Employment and reduced consumption:

Cruces, G., Cicowiez, M., Falcone, G., & Puig, J. (2021). Incidence of Tobacco Taxation in Argentina: Employment and Economy-Wide Effects [Report]. CEDLAS. https://www.tobacconomics.org/files/research/699/research-report-cedlas-tobacco-2020-en.pdf.

Huesca, L., Sobarzo, H., & Llamas, L. (2021). A General Equilibrium Analysis of the Macroeconomic Impacts of Tobacco Taxation [Report]. CIAD. https://www.tobacconomics.org/files/research/723/reporte-tabaco-en.pdf.

Sabir, M., Saleem, W., Iqbal, M.A., & Aamir, N. (2021). Economic Implications of Cigarette Taxation in Pakistan: An Exploration Through a CGE Model [Report]. SPDC. https://tobacconomics.org/files/research/726/spdc-rp-cge-report-final.pdf.

Consumption (map and regional figure):

Euromonitor. Passport database (accessed in April 2022).

GlobalData. 2021 database. www.globaldata.com.

Menthol:

Przewoźniak K, Kyriakos CN, Hiscock R, Radu-Loghin C, Fong GT. Effects of and challenges to bans on menthol and other flavors in tobacco products. Tob Prev Cessat. 2021 Nov 15;7:68. doi: 10.18332/tpc/143072.

Villanti AC, Collins LK, Niaura RS, Gagosian SY, Abrams DB. Menthol cigarettes and the public health standard: a systematic review. BMC Public Health. 2017 Dec;17(1):1-3.

Villanti AC, Mowery PD, Delnevo CD, Niaura RS, Abrams DB, Giovino GA. Changes in the prevalence and correlates of menthol cigarette use in the USA, 2004–2014. Tobacco control. 2016 Nov 1;25(Suppl 2):ii14-20.

Reduced nicotine cigarettes:

Donny EC, White CM. A review of the evidence on cigarettes with reduced addictiveness potential. International Journal of Drug Policy. 2021 Sep 15:103436.

Smoking prevalence projections:

WHO global report on trends in prevalence of tobacco use 2000-2025, fourth edition. Geneva: World Health Organization; 2021.

This Free Life campaign:

US Food and Drug Administration. 2022. This Free Life Campaign. https://www.fda.gov/tobacco-products/public-health-education-campaigns/free-life-campaign. Last accessed 5/3/2022.

Employment and reduced consumption:

Cruces, G., Cicowiez, M., Falcone, G., & Puig, J. (2021). Incidence of Tobacco Taxation in Argentina: Employment and Economy-Wide Effects [Report]. CEDLAS. https://www.tobacconomics.org/files/research/699/research-report-cedlas-tobacco-2020-en.pdf.

Huesca, L., Sobarzo, H., & Llamas, L. (2021). A General Equilibrium Analysis of the Macroeconomic Impacts of Tobacco Taxation [Report]. CIAD. https://www.tobacconomics.org/files/research/723/reporte-tabaco-en.pdf.

Sabir, M., Saleem, W., Iqbal, M.A., & Aamir, N. (2021). Economic Implications of Cigarette Taxation in Pakistan: An Exploration Through a CGE Model [Report]. SPDC. https://tobacconomics.org/files/research/726/spdc-rp-cge-report-final.pdf.