References

Percentage of total deaths attributable to tobacco use among both sexes, by World Bank Income Group 2019:

GBD 2019 Risk Factors Collaborators. Global burden of 87 risk factors in 204 countries and territories, 1990-2019: a systematic analysis for the Global Burden of Disease Study 2019. Lancet. 2020, 396: 1223-49.

Financing required to achieve SDG health targets:

Stenberg K, Hanssen O, Edejer TT, Bertram M, Brindley C, Meshreky A, Rosen JE, Stover J, Verboom P, Sanders R, Soucat A. (2017). Financing transformative health systems towards achievement of the health Sustainable Development Goals: a model for projected resource needs in 67 low-income and middle-income countries. Lancet Glob Health. 5(9):e875-e887.

Revenue and health projections from 50% tobacco price increase:

Summan A, Laxminarayan R. (2018). Estimating Global Effects of Tobacco, Alcohol, and Sugary Beverage Taxation. Background Paper for the Task Force on Fiscal Policy for Health. New York: Bloomberg Philanthropies.

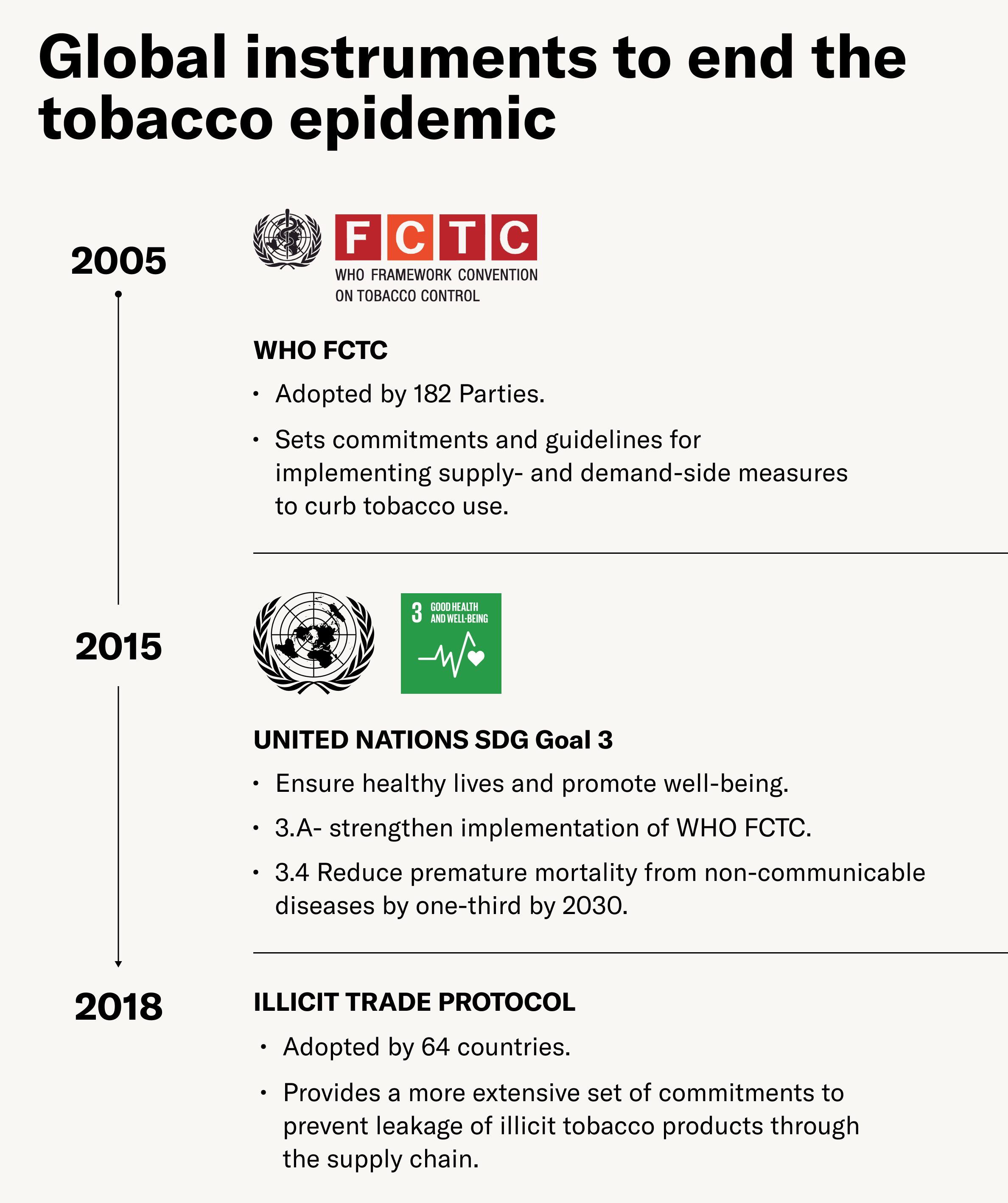

Global treaty on tobacco control:

World Health Organization. (2003). WHO framework convention on tobacco control. Geneva: WHO.

Progress on MPOWER measures from 2007-2020:

World Health Organization. (2021). WHO report on the global tobacco epidemic, 2021. Geneva: WHO.

Percentage of total deaths attributable to tobacco use among both sexes, by World Bank Income Group 2019:

GBD 2019 Risk Factors Collaborators. Global burden of 87 risk factors in 204 countries and territories, 1990-2019: a systematic analysis for the Global Burden of Disease Study 2019. Lancet. 2020, 396: 1223-49.

Financing required to achieve SDG health targets:

Stenberg K, Hanssen O, Edejer TT, Bertram M, Brindley C, Meshreky A, Rosen JE, Stover J, Verboom P, Sanders R, Soucat A. (2017). Financing transformative health systems towards achievement of the health Sustainable Development Goals: a model for projected resource needs in 67 low-income and middle-income countries. Lancet Glob Health. 5(9):e875-e887.

Revenue and health projections from 50% tobacco price increase:

Summan A, Laxminarayan R. (2018). Estimating Global Effects of Tobacco, Alcohol, and Sugary Beverage Taxation. Background Paper for the Task Force on Fiscal Policy for Health. New York: Bloomberg Philanthropies.

Global treaty on tobacco control:

World Health Organization. (2003). WHO framework convention on tobacco control. Geneva: WHO.

Progress on MPOWER measures from 2007-2020:

World Health Organization. (2021). WHO report on the global tobacco epidemic, 2021. Geneva: WHO.