How many people die from smoking in Philippines each year?

What is the economic cost of smoking and tobacco use in Philippines each year?

Philippine pesos

Current Rates of Smoking and Tobacco Use in Philippines

Tobacco use continues to be an epidemic in Philippines. Government complacency in the face of the tobacco epidemic protects the tobacco industry in Philippines as the death toll grows each year. Proponents of healthier societies must push for the implementation of evidence-based best practices in tobacco control to create change and reduce the negative effects of tobacco use.

Adult Smoking Prevalence in Philippines

15+ years old; 2022

Men

36.2%

Women

4.3%

Adult smoking prevalence in Philippines is 20.4%.

Number of Adult Smokers in Philippines

15+ years old; 2022

Men

14,252,461

Women

1,715,881

Number of adult smokers in Philippines is 16,172,234.

Youth Smoking Prevalence in Philippines

10-14 years old; 2022

Men

12.9%

Women

5.9%

Youth smoking prevalence in Philippines is 9.4%.

Adult Smokeless Tobacco Use in Philippines

15+ years old; smokeless tobacco includes snus, chewing tobacco, gutkha, etc.; 2021

Both Men and Women

2%

Adult smokeless tobacco use prevalence in Philippines is 2%.

Deaths Caused by Tobacco in Philippines

% deaths attributable to tobacco use in 2021

Men

13.3%

Women

5.3%

10.0% of all deaths in Philippines are caused by tobacco use.

Learn more about global Prevalence, Youth Smoking and Deaths.

Negative Effect of Tobacco Use in Philippines

Tobacco use harms both the public and fiscal health of Philippines, threatening efforts to improve equity, alleviate poverty, and protect the environment.

Societal Harms

The economic cost of smoking Philippines is 261,328,947,321 Philippine pesos. This includes direct costs related to healthcare expenditures and indirect costs related to lost productivity caused by illness and premature death.

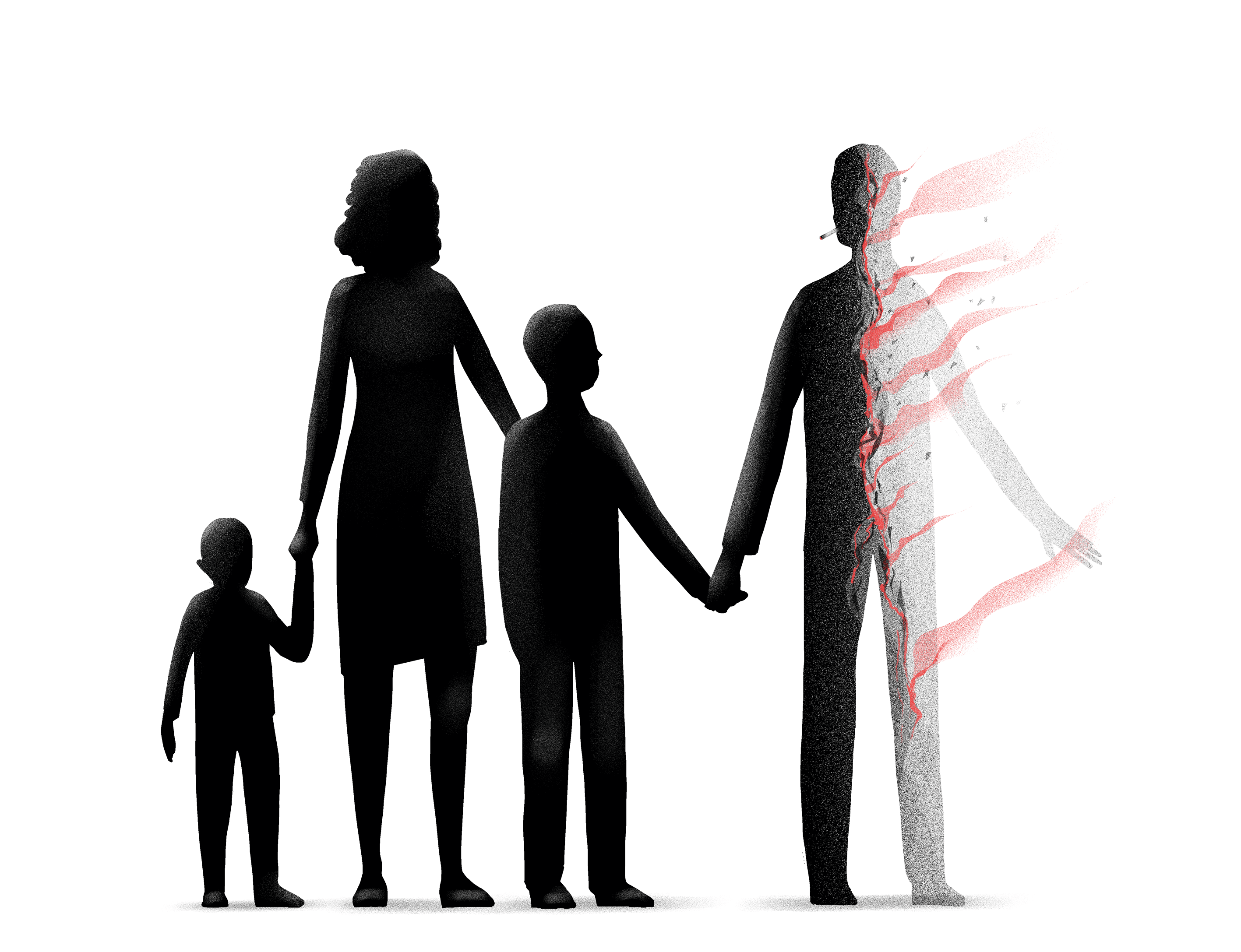

Harms Development

Tobacco spending diverts funds from the resources that families need to rise out of poverty. On average in Philippines, a smoker must spend 7.1% of GDP per capita to buy 100 packs of the most popular cigarettes in a year.

Environmental Harms

Cigarette butts are the most commonly discarded pieces of waste worldwide. It is estimated that 15,624 tons of butts wind up as toxic trash in Philippines each year, equal to 5,787 female African elephants.

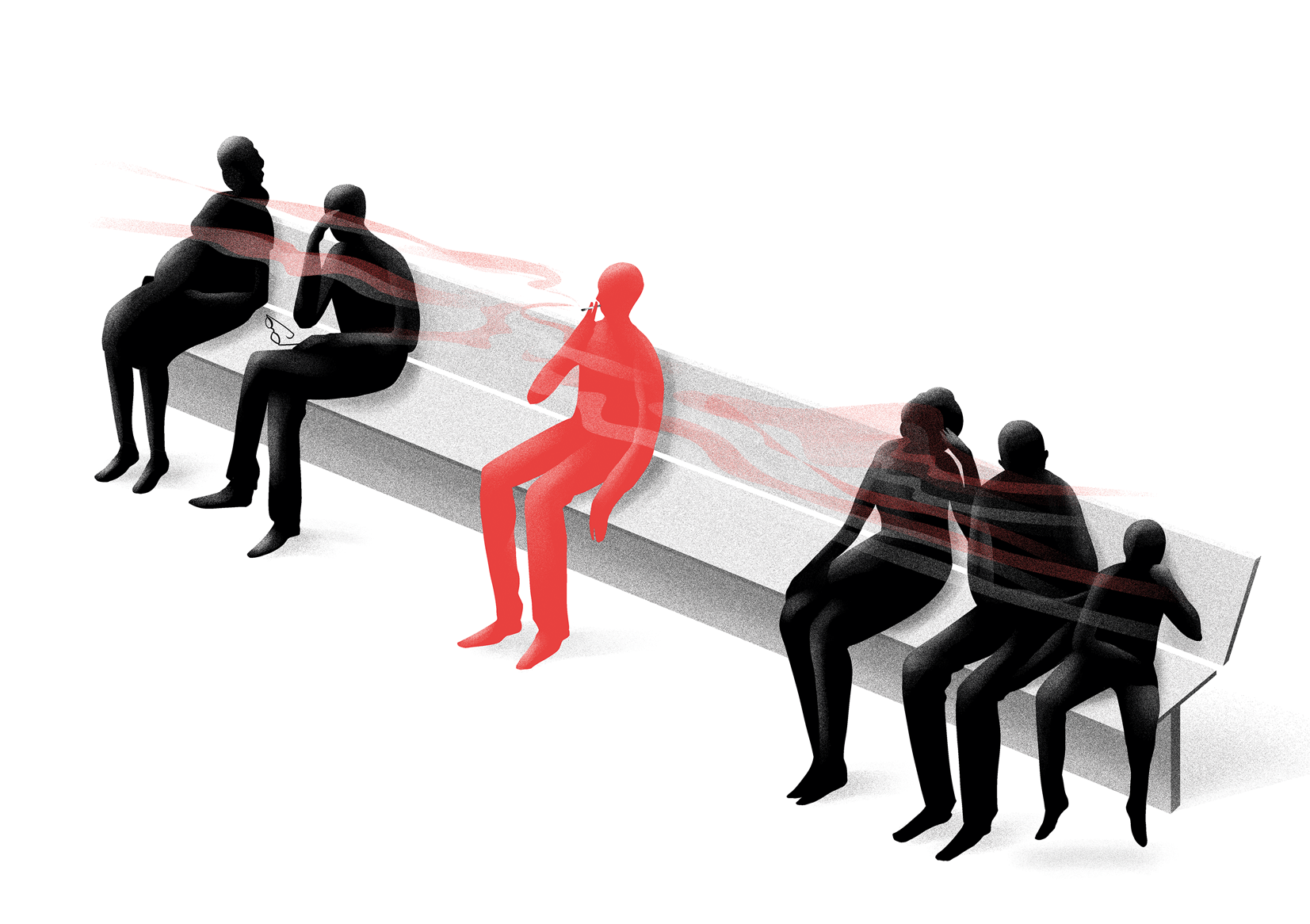

Harms Health Equity

The tobacco industry markets its products aggressively to lower-income populations and youth in Philippines.

Harms NCDs

Not only is smoking a major risk factor for the 4 largest noncommunicable diseases (cancer, heart diseases, respiratory diseases, and diabetes), but people living with mental illness are nearly 2x as likely to smoke as other individuals.

Learn more about Health Effects.

Impact of the Tobacco Supply Chain on Philippines

The tobacco industry profits significantly from producing and selling tobacco. At the same time, across the tobacco supply chain, there are significant negative health and economic repercussions for Philippines.

Tobacco Production

There were approximately 78,118,500,000 cigarettes produced in Philippines in 2023.

Tobacco Industry

The total revenue of the 6 largest tobacco companies in the world was USD 362 billion in 2022, about the same as Pakistan's Gross National Income (GNI), 5x Panama's GNI and 9x Paraguay's GNI.

Tobacco Growing

There were 47,730 tons of tobacco produced in Philippines in 2022 on 29,062 hectares of quality agricultural land that could have been used to grow food.

Learn more about global Product Sales and Growing.

Fortunately, there are evidence-based—i.e. proven—solutions to the challenges posed by tobacco use. For several decades, governments around the world have been introducing a set of policies that address the demand for tobacco products, particularly among youth. These policies effectively reduce consumption and are cost-effective because they save goverments enormous amounts of money in health care spending and increase economic productivity.

Yes

Healthcare Facilities

Yes

Educational Facilities

Yes

Universities

Yes

Government Facilities

No

Indoor Offices

No

Restaurants

No

Pubs and Bars

Yes

Public Transport

N/A

All Other Indoor Public Places

Yes

Funds for Enforcement

Availability of Cessation Services in Philippines

Quitting Resources

National quit line, and both NRT and some cessation services cost-covered

National Quit Line

Yes

Learn more about best practices in Cessation.

Tobacco Packaging Regulations in Philippines

Quality of Tobacco Packaging Regulation

None

Text warning label only

Text warning label with graphic warning label

Plain Packaging with text/graphic warning label

% of Pack Covered

50%

Learn more about best practices in Counter Marketing.

Tobacco Control Mass Media Campaigns in Philippines

Ran a National Anti-Tobacco Campaign

Part Of A Comprehensive Tobacco Control Program

Pre-Tested With The Target Audience

Target Audience Research Was Conducted

Aired On Television And/Or Radio

Utilized Media Planning

Earned Media/Public Relations Were Used To Promote The Campaign

Process Evaluation Was Used To Assess Implementation

Outcome Evaluation Was Used To Assess Effectiveness

Learn more about best practices in Mass Media.

Tobacco Tax Policies in Philippines

Using evidence-based international recommendations/best practices, the Tobacconomics Cigarette Tax Scorecard assesses four components of tax systems — price, change in affordability, tax share, and structure — on a scale of 0 to 5, where a higher score is preferred.

The overall score is an average of the four component scores.

Consumers respond to higher prices by decreasing consumption and some quit using tobacco.

In addition to price, change in affordability is critical. Cigarettes need to become less affordable for consumption to decline.

Large tax shares of price are usually a good indicator that taxes are working.

Best practices include relying more on uniform specific excise taxes that are adjusted regularly to outpace growth and inflation.

Learn more about the Scorecard in Philippines.

Regulations on Tobacco Advertising, Promotion, and Sponsorship (TAPS) in Philippines

Marketing is the key avenue that tobacco companies use to reach consumers, new and old. Restricting or eliminating marketing is key to tobacco control success.

Direct Bans 6 out of 7 direct bans implemented

National TV and radio

International TV and radio

Local magazines and newspapers

International magazines and newspapers

Billboard and outdoor advertising

Advertising at point of sale

Advertising on internet

Ad Ban Compliance: 75%

Indirect Bans 1 out of 10 direct bans implemented

Free distribution in mail or through other means

Promotional discounts

Non-tobacco products identified with tobacco brand names

Brand name of non-tobacco products used for tobacco product

Appearance in TV and/or films: tobacco brands (product placement)

Appearance in TV and/or films: tobacco products

Prescribed anti-tobacco ads required for any visual entertainment media product that depicts tobacco products, use or images

Complete ban on sponsorship

Any form of contribution (financial or other support) to any event, activity or individual

Ban on the publicity of financial or other sponsorship or support by the tobacco industry of events, activities, individuals

Ad Ban Compliance: 75%

Source: GTCR

Citation: Drope J, Hamill S, editors. 2025. Country profile: Philippines. In The Tobacco Atlas. New York: Vital Strategies and Economics for Health.